This course has 1 goal only.

My goal is to help you start trading and potentially make money on the forex market

This course is enough for you to know all the basics of the forex market and be able to place your first trades

Here is what you will learn

📲 What is Forex

📲How do traders make money

📲How to choose and create and account with a broker

📲How to use trading platforms like Metatrader 5

📲Basic Forex terms that you will meet

📲How to place your first trades and how to calculate your profits

Once you learn these, you are good to go and trade and on your own

Now let’s get going into our first lesson

If you want to get the most out of this course, pay attention and read to the end of the course

What is Forex?

When you hear about this word, what comes to mind?

Cars, Mansions, Instagram gurus with a lot of cash?

Well that’s what most think but let break down what this thing is and most importantly how you can make money with it

Forex is the shortcut for Foreign Exchange

Foreign Exchange means exchanging 2 currencies from once currency to another currency

For exchange exchanging US dollar to South African Rand, US Dollar to Pula or USD to Naira

You must have exchanged currency at some point in your life

If you did, then you are a forex trader already😜

When 2 currencies are being exchanged, there is a rate that you agree with the money changer right?

If you have ever noticed, these rate are always changing and the reason why they change is because some people are profiting from it and some are losing money from it

If you have been to the bank, you will see that there will be a chart somewhere in the bank with a list of currencies and their rates

It looks like this picture below

These exchange rates show you how valuable is once currency to another and will talk more about it later

Now let me give you an example of how you make money as a trader

Let’s assume that you live in South Africa and you have 50 000 rands in your bank account and you want to go United States for a trip with your girlfriend

So you go to the Bureau de Change center and exchange the R50 000 to USD$

When you get to the Bureau de Change, they tell you that the exchange rate USD$1 = R10

*So that means on your R50 000 they will give you USD$5000*

So you agree and the deal is done

You just made the first step of trading which in this case you are buying USD using Rands

Now 3 days after that deal, you catch your girlfriend cheating on you

Now at this point and you are crying, you cancel the trip and you go back to the Bureau de Change center to exchange back your Rands

When you get there, you realise the exchange rate have change to USD$1= R15

Now this means for the same $5000 your got for 50k you will now sell it for higher price and get R75 000

That’s an extra R25 000 in profit🤑

Now at this point, do you blame your girlfriend for cheating on you?

I bet no… 😂

Now let get back and let me explain why you made then 25k Rands in profit

Exchange rates are always changing every day

So as the exchange rate moves, we can make money buy buying currencies at a lower price and selling them when the rate rises

Let me explain

In the example about

On day 1, the exchange rate was 1:10 which means for every 1 dollar you would get 10 rands

So for 50 000 rands, they gave you 5000 dollars

So now you bought rands and a lower exchange rate

If the rate rise like it did here to go to 1:15 it means you can sell at a higher price

When you bought at first, you got to hold $5000 so it means now if you want to sell it back to rands you will sell at a higher rate and you profit from the difference

In this example you sold the $5000 you got at a rate of 1:15 which means you will get 75 000 rands for the same 50k that you invested into USD 3 days ago

You can see how it works now right

If not, re read the messages above from the example

Now before we move forward, let me make something clear, you don’t need to go to the Bureau de Change center to trade forex

You also don’t need to R50 000 rands to start

With Forex Trading you can trade from your phone and you can start from as little as $10 and I will show you how to do it.

First let me explain what the Forex Market is all about

The Forex Market is the biggest financial market in the world with around 6 trillion dollars being traded every single day

Yes there is a market like this and you didn’t know it😁

Ok let me tell you more about this market

The Forex Market is a spot market or a decentralized market which means anyone from anywhere can join the market and buy or sell currencies

This market have 5 main market players that trade Forex

1. Banks

Banks trade forex for many reasons, including making profits

2. Companies

Imagine Honda trying to buy car parts in USA what do they do, the change Japanese yen to USD so they can buy easily, right?

3. Governments

When your government is trying to buy goods from another country, they will need to exchange currencies

4. Hedge Funds

Hedge funds are companies that you can invest your money in them and they trade that money with the goal to make money

(I’m not talking about scammers who call themselves account managers)

These are big companies that needs millions to invest

5. Retail Traders

This is me and you

Retail traders go in the market for one reason only, to make profits.

You are a retail trader and you can only join the market via a broker

(picture market players)

How to join the market

To start buying and selling instruments on the forex market, you need to create a trading account with a broker

This account is free to create and most brokers will give you a $10 000 plus demo account to practice

Which means you can practice to trade without putting your own money in the market

When you want to start trading real money, you will deposit money into your trading account and you start trading.

The minimum you can deposit depends with the broker but from $5

Before i share with you the broker i use personally, let me talk more about brokers

What is a Forex Broker

A forex broker is a company that connects you to the market and you trade through them

When you want to buy or sell a currency pair, all you have to do is go to your trading platform that the broker provides and you will buy or sell with a click of a button

Brokers also allows you to trade huge amounts even if you don’t have them because of what is called leverage

We will explain more about it later

Click this link to see an example of a broker that I use https://bit.ly/39uRXJn

How to choose a good broker

Choosing a good broker is very important because when you are putting your money online, you need to beware of scammers

If you put your money into an untrusted broker, they may disappear with your money

Here are a few things to look for into a broker before choosing

1. Regulation

Your broker needs to be registered with different financial services to make sure they remain fair to their users

2. Deposit and Withdrawals Methods

You need a broker that is easy to deposit or withdraw your at any time as you wish.

Also depending on your country of residence, some brokers only allows Visa cars or Mastercards for deposits and withdrawals.

I will show the best broker in terms of these payments methods

3 Customer Service

Whenever money is involved, customer care is the most important thing to look for right.

4. Experience

How long has this broker been operating and how many users do they have?

There are many factors but i won’t go through them all, I will show you the broker that I use and I would recommend

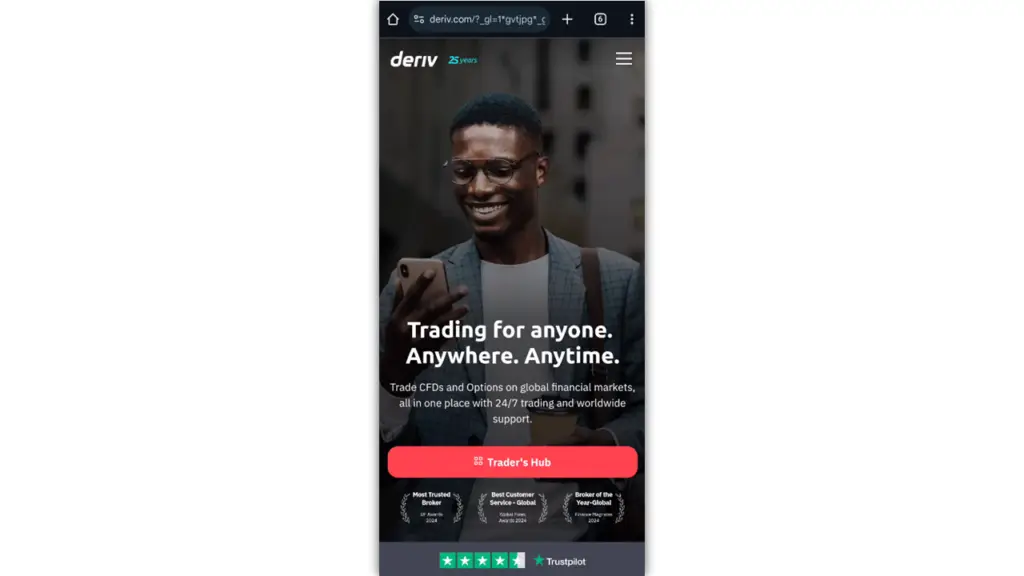

The broker that I personally use is called Deriv.

Deriv have been one of the most popular brokers and the main reason i like about them is that they focus much on traders in Africa and around the world

They allow you to deposit or withdraw money into your account using most of the ewallets found in Africa

They also have been in the market for more than 20 years now and they were previously known as Binary. com

Also with Deriv you can trade more than just currencies.

Obviously when you learn more about this business, you might want to trade also things like Gold, Indices, Commodities or Crypto or Binary Options

Deriv allows you to do all these with one account

They also allow provides you 3 trading platforms and you will choose which one is best for you

They also give you a $5 000 practice account called Deriv Demo Account

For now I want you to create a demo account so that when I start showing you how to place your trades, you will be able to do the same

(Video with caption. Watch this video to learn how to create a deriv account)

After creating the account, you now have 10 000 dollar demo account but you will also have to connect the account to a trading platform called Metatrader 5

So now everyone show go and create their accounts and when we come back, i will starting teaching the basic terms of Forex trading and how to place your first trades

Give the 1 hour to do that

Have you created your account and connected it to Metatrader?

If not, go and do that because today we will be dealing with the Metatrader 5 platform and all examples will come from this application

For now, let me show you the basics terms and answer basic questions

What are you buying or selling

The answer is simple, money.

If you think about it, money have value and its value changes everyday

This means you can be able to buy it at a lower price and sell it at a higher price

All you need is a another currency to trade it with

So these 2 currencies you are using to buy and sell are called currency pairs

What are currency pairs

Currency pairs are two currencies that are being compared to each other to trade

Each country have a currency and every currency have value against another country’s currency

For example the US dollar vs the Rand. there is a rate for it and the rate always chances

The reasons of the exchange rates can be political, economical or whatever but it always changes, in every second

So a currency pair is a pair of currencies that are being compared to each other

How a pair is formed

Since the currency pairs have 2 currency, it’s important to understand what each currency means

Here is a currency pair, we are going to use as an example

USD/ZAR 15.10

This currency pair is the USD compared to the ZAR which is the Rand

The first currency in the pair is called the Base currency

The second currency in the pair is called the Quote currency

The number you see in front is the exchange rate that the pair have at that point but its always changing up and down

These currencies pair is what you be buying or selling

Currency pair can be divided into 3 categories depending on how much they are traded

Major Pairs

Major pairs are the most traded pairs. These pairs are what you will most likely trade because they have small spreads (more on that later)

The USD is the most traded pair in the market

Almost all the Major Pairs have one of the pair being the USD

Minor Pairs

Minor pairs are the pairs that are not much traded but they contain one of the major pairs

(Picture Minor Pairs)

When you do open Metatrader 5 you will see a list of currency pairs on the Quotes page

Bid/Ask and Spreads

If you noticed, yet every pair have 2 exchange rates is front of it

These exchange rates are a little bit different

The first is the *Ask Price* which is the *BUY PRICE*

When you want to buy a pair, that is the price you will be buying at.

The second is the Bid Price which is the price that you will be Selling at

If you noticed, there is a difference between the prices

The difference between is called the Spread

The spread is a commision that the broker takes for every trade you place.

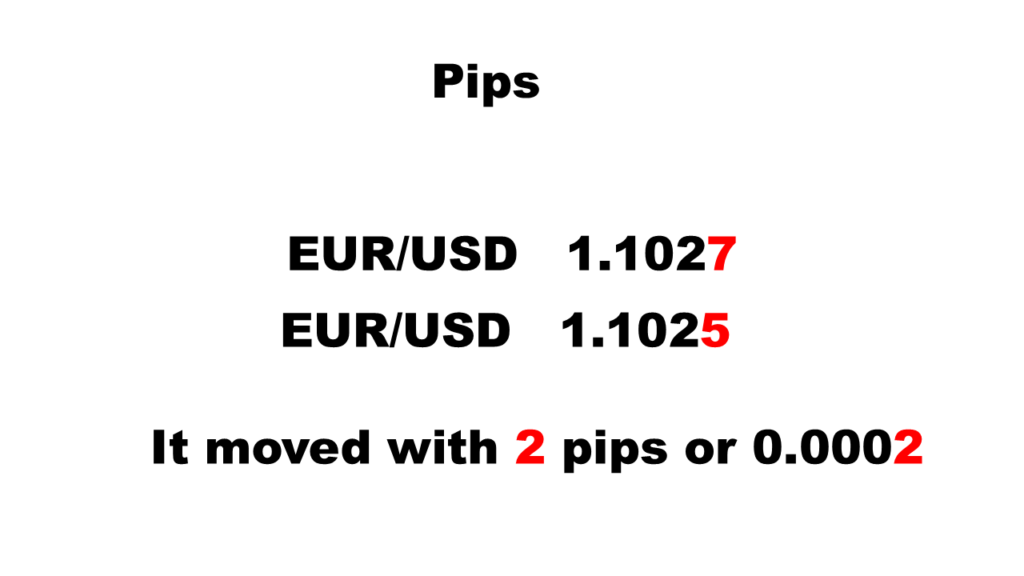

Pips

_Pay attention here because that’s when we do some calculations_

A pip is the smallest movement that a currency pair can make

If you noticed yet, these exchange rates doesn’t move very much

Someone who is not a trader might not even notice. But as traders we look to the smallest movement of the pair

In real life, we count money as 1 dollar 20 cents because its written like this $1.20

But for traders we will look beyond that and our exchange rate will be like $1.2025

So the smallest decimal place here is 4th decimal place and that’s what is called a pip

A pip is the fourth decimal number of the exchange rate and it is equal to 0.0001

As the exchange rate moves, we measure it using these pips

To get the number of pips that the market moves with, we simply subtract the old exchange rate from the new exchange rate

Let me show some examples

Let’s say the exchange rate for EUR/USD moves from 1.2025 to 1.2028

This means, if we subtract 1.2028-1.2025 we will get 0.0003

This means the market moved with 3 pips

Let’s say the exchange rate for GBP/USD moved from 1.0950 to 1.0980

We subtract 1.0980-1.0950 and we will get 0.0030

That means the market moved with 30 pips or 0.0030

You can learn these by practicing using any exchange rate you want

Now as you can see, the market moves only in pips and the moves are very small

So how do we make big profits from a 0.0003 move?

We use something else called lots

Lots and pips work together and let me show you what is it all about

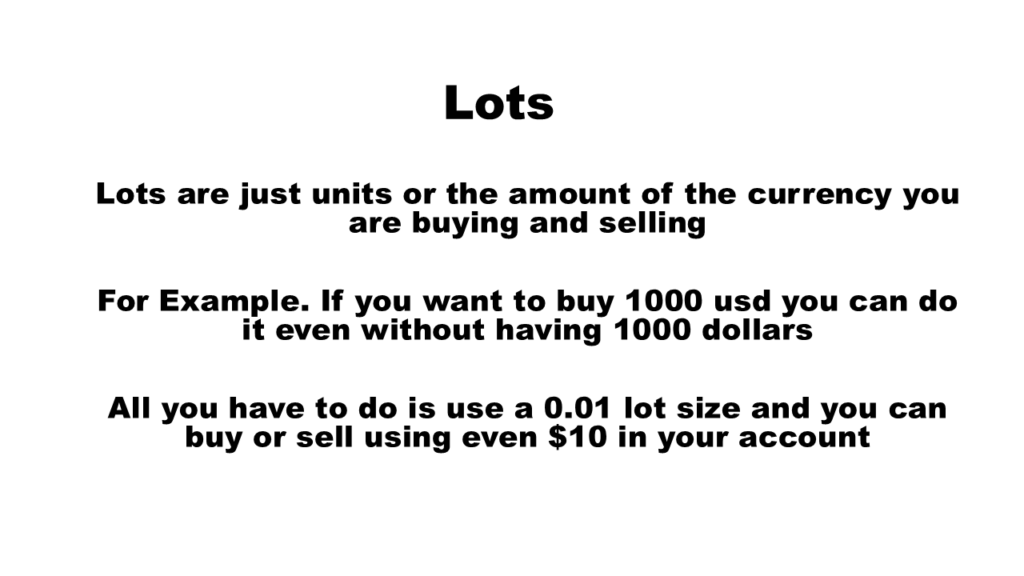

Lots

A lot is a bundle of units of currencies that you are buying or selling in the market

For example, when you want to buy 1000 USD in the market, instead of choosing 1000 you just choose a 0.01

I will show the good part of this

Now for lots, we can choose from 0.01 lot to 100 lots depending on your account size

But basically we have 3 types of lots

1. We have a STANDARD LOT which is 100 000 units of currency

If you buy or sell 1 lot in any pair, you are buying 100 000 of that pair

*On Metatrader, you select Standard Lot by 1*

2. We have a MINI LOT which is 10 000 units of currency

When you buy or sell a mini lot, you are buying 10 000 units of that currency

On Metatrader, you select mini lot by 0.10

3. We have a micro lot, it means 1 000 units of currency

When you buy or sell a micro lot you are buying 1000 units of currency

On Metatrader, you select micro lot by 0.01

So how does all this work together? Well here is where the whole trading works

Pips and lots work together

Pips and Lots and how they work together

When you place a trade, meaning buying or selling, you select the lot size you want to use

As i said, the lot size determines how big your trade is

So let’s take one of our examples above

Let’s say the exchange rate for GBP/USD moved from 1.0950 to 1.0980. We subtract 1.0980-1.0950 and we will get 0.0030. That means the market moved with 30 pips or 0.0030

From this example, you could have made either $300, or $30 or $3 depending on which lot size you used

let me show you how

If you use a standard lot which is represented by 1.

That means its $100 000 multiply that by 0.0030 we will get $300 profit

Or if we use a Mini lot which represents $10 000 multiply by 0.0030 we will get $30

If we used the Micro lot, which is $1000, multiply that by 0.0030 we get $3

Here is how to remember this easily

If you use a STANDARD LOT, each pip movement is worth $10, which means you win or lose $10 per pip

If you use a MICRO, each pip movement is worth $1, which means you win or lose $1 per pip

If you use a micro lot, each pip movement is worth $0.10, which means you win or lose $0.10 per pip

Also remember that you are not limited to place only these lot sizes, you can place any lot size you need

For example you can place 5 mini lot by choosing 0.05 and you will winning or losing $0.50 per pip

But you might be thinking, but Courage i don’t have $1000 to trade or i don’t have 100 000 to trade

Well here is the good thing, you don’t need it because of what is called leverage that the broker gives you

Leverage allows to trade money you don’t have

Brokers only require you to make a deposit into you account and they will allow you to trade an amount up 500 times the amount you deposited

For example, you can deposit $10 and make $1000 trade

You can deposit $100 and trade a $100 000 trade

But what does the broker get? Well this is risk free to the broker because every profit or lose you make is directly connected to your account

For example, let’s say you have $100 in your account and place a standard lot.

If the market moves 10 pips in the direction you want, each pip is worth $10 so on 10 pips you will double your account🤑

But if the market goes against you, after 10 pips you will lose your account and the broker will automatically close the trade because you will have no money in your account🤔

And you have started hearing me talking about losing now

That because yes in the market you can lose money too

Here is how

In trading you make money in 2 ways

If you Buy a pair and its exchange rate rises, you make profits because you are buying low prices and selling high prices

You can also Sell a pair and its exchange rate falls, you make profit because you are *selling at a high price and you will buy back at a lower price*

But if you buy thinking the rate will rise, if it falls you will lose money

If you Sell thinking the exchange rate will fall but it didn’t and rises instead your trade is wrong and you will lose money

All this makes sense and it’s easier when you start placing your trades in Metatrader 5

For now, what i want you to do is go into Metatrader 5 and start placing some random trades to see how it works

But before you do that, let me give you a quick overview of how to place your first trades on Metatrader

Introduction to Metatrader 5

Metatrader 5 will be the platform you will be using to trade everyday

Metatrader will be connected to your account so every trade you place will be placed in Metatrader 5 and the money will add up or deduct on your account

Here is quick overview of Metatrader 5

When you download Metatrader 5 for the first time, they will automatically create a demo account for you

You can add also the add your own brokers account

The videos above showed you how

In Metatrader 5 you have 5 main pages

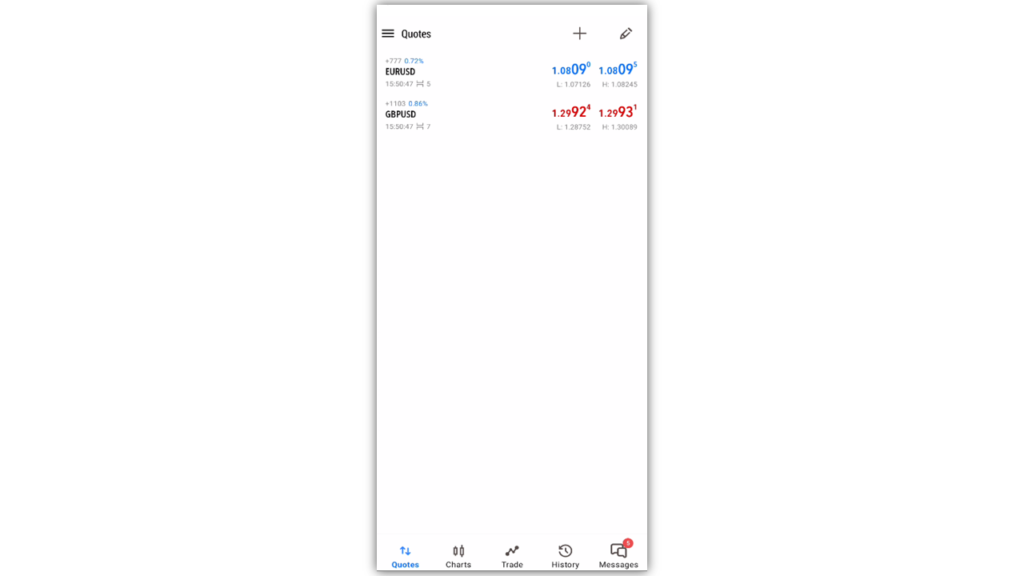

- The quote page

This is where you will see all the pairs and all the exchange rates

You can add up other pairs that don’t come as default

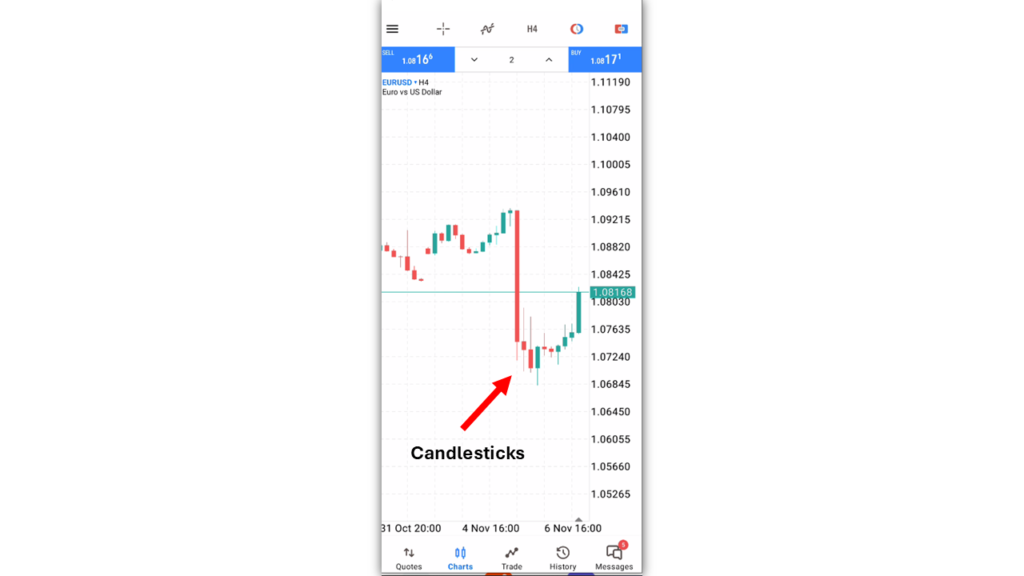

- The chats page

The charts page is where you see how the market have been moving in the past

You use this data to analyze and predict the future movement

_you will learn more of this in technical analysis lessons_

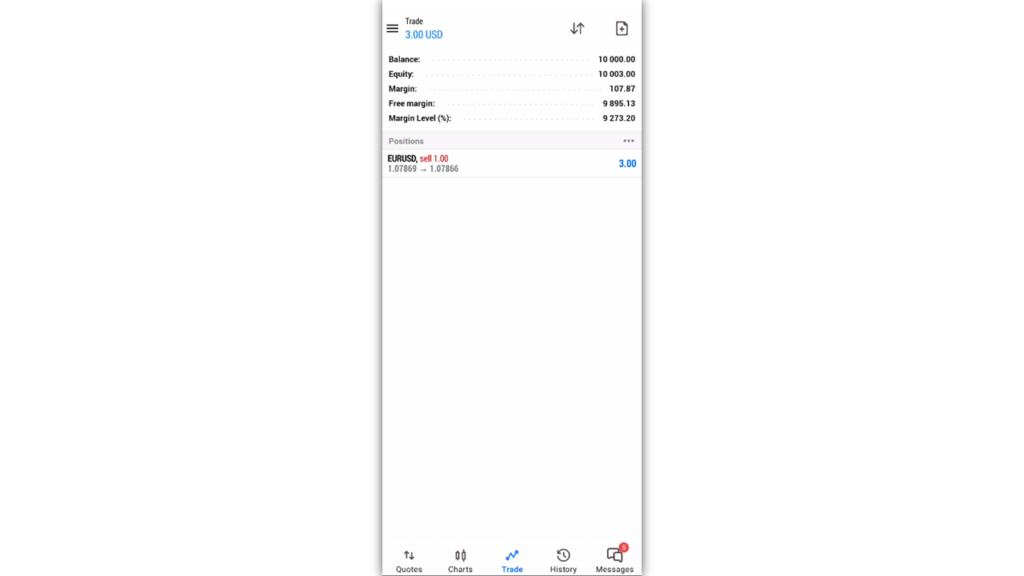

- The Trade Page

Here you will be seeing your current running trades

If you are in profit, this page turns blue and if you are in loss, the screen turns red

- History Page

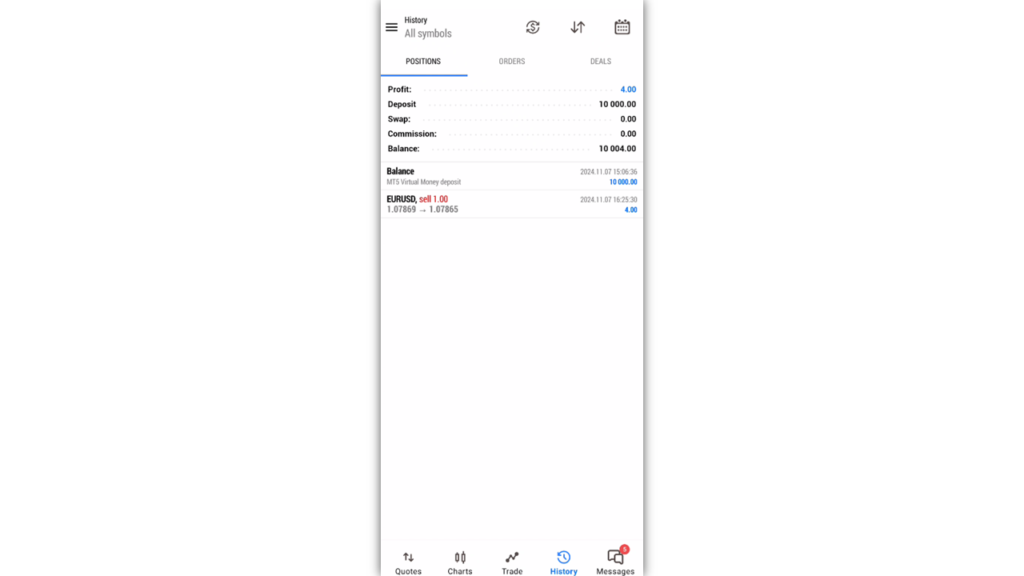

This is where you see the result from your closed trades.

Now you can go ahead and start placing your random trades and see how things go

Now Create Your Account Here And Start Practising